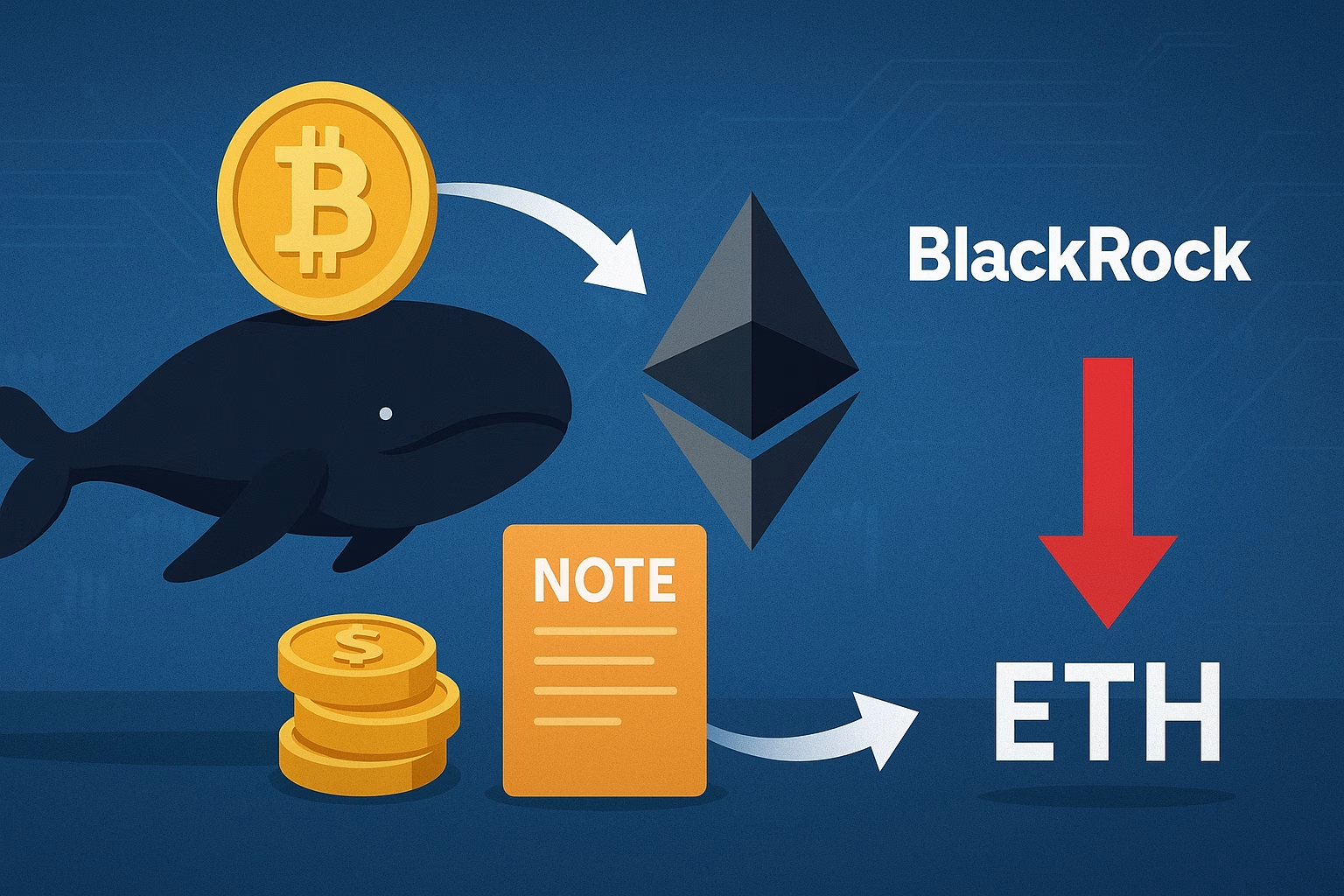

Bitcoin Whale Shifts $95M Fortune to Ethereum ETF in Bold DeFi Bet

A major Bitcoin whale has executed a headline-grabbing shift in strategy, liquidating over $94.9 million in BTC to buy Ethereum.

The move was conducted through Hyperliquid, a decentralized exchange that now controls 75% of the perpetuals market with $6.2 billion in user assets. On-chain data shows the whale exchanged more than 400 BTC, securing 11,744 ETH worth roughly $50.6 million.

But the activity did not stop there. The investor went on to open $295 million in leveraged ETH long positions across four wallets, using between 3x and 10x leverage.

Analysts say this marks a broader trend of Bitcoin holders rotating into Ethereum to capitalize on DeFi growth and higher upside potential in derivatives markets. Despite ETH volatility and a dip to $4,063 earlier this week, whales appear undeterred.

Bitcoin advocate Samson Mow, however, cautioned that such moves could reverse once profit targets are met. According to Mow, seasoned Ethereum holders may rotate back into BTC, potentially leaving newer investors exposed.

DBS Bank Tokenizes Structured Notes on Ethereum

Adding to Ethereum’s growing financial role, DBS Bank, Singapore’s largest lender, has launched tokenized structured notes on the Ethereum blockchain. Partnering with ADDX, DigiFT, and HydraX, DBS has introduced $1,000 fractional shares of structured notes that previously required $100,000 minimum investments.

The move is designed to broaden investor access while reducing settlement times. The bank plans to extend tokenization to equity and credit-linked notes, reinforcing Singapore’s leadership in digital asset innovation. With over 2,000 family offices in the city-state, analysts expect demand for tokenized products to grow rapidly.

BlackRock Outflow Sends ETH Below $4,100

Meanwhile, Ethereum’s price dipped below $4,100 after BlackRock’s Ethereum ETF suffered a $257 million outflow, its second-largest ever. Bitcoin also saw $220 million in redemptions on the same day, signaling broader institutional caution.

While analysts clarified that the withdrawals reflected routine ETF redemptions rather than BlackRock cutting exposure, the outflows highlight how sensitive crypto markets remain to institutional flows. Some traders expect a rebound similar to past episodes, while others warn that current macroeconomic conditions may prevent a quick recovery.

Bottom Line

The cryptosphere is being reshaped as whales shift from Bitcoin to Ethereum, banks tokenize assets on Ethereum, and institutions drive market volatility. Together, these developments underscore Ethereum’s expanding role at the heart of both DeFi and traditional finance, even as its price faces headwinds from ETF outflows.

About Author